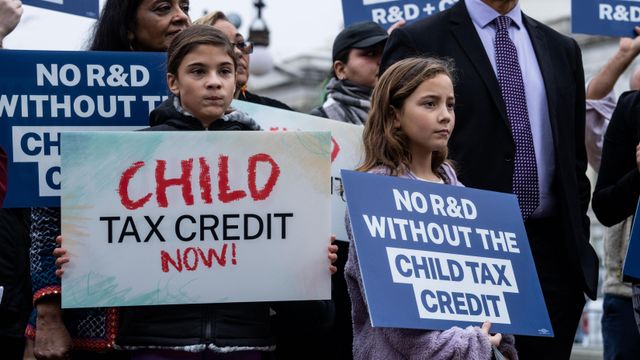

Billions in tax breaks could help some parents. Here's how

House GOP leaders continue to push a $78 billion bipartisan tax package that would temporarily expand the child tax credit and restore a number of business tax benefits. But many hurdles remain, and whether it ultimately passes both chambers is in doubt.

Overall, the deal would reduce federal revenue by $399 million over 10 years.

Here are the details:

Child tax credit expansion

What the deal would do:

It would increase the maximum refundable credit for households who owe little or no income taxes. That would enable lower-income families to claim more of the credit.

Low-income families with more than one child would receive the same credit for each of their children, just as higher-income families already do.

Families would have the choice of using their earnings in the current year or prior year, in case their earnings were volatile.

The credit would be adjusted for inflation starting in 2024.

The provisions would be in effect for three tax years, from 2023 through 2025.

What the deal would not do:

Unlike the temporary child tax credit expansion in the 2021 American Rescue Plan Act, the current deal would not increase the size of the credit for many families to as much as $3,600, nor make the full credit available to low-income families regardless of earnings, nor distribute half of it on a monthly basis.

It would not change the minimum earnings threshold of $2,500 needed to begin to claim the credit.

It would not change the requirement that children must have Social Security numbers for their families to file for the credit.

What are the objections:

Some Republicans are concerned that the proposal would disincentivize work and that more undocumented immigrants would claim the credit.

House Ways and Means Committee Chairman Jason Smith, a Missouri Republican, has pushed back on this, citing the minimum earnings threshold and Social Security number requirement.

Some Democrats, including Rep. Rosa DeLauro of Connecticut, the top Democrat on the House Appropriations Committee, are upset that the deal doesn’t make the full credit available to more families with no or very low incomes.

What the impact on families would be:

The deal would provide a larger credit in the first year to the low-income families of roughly 16 million children, or more than 80% of those who currently don’t receive the full credit because their families earn too little, according to the left-leaning Center on Budget and Policy Priorities.

Half of the roughly 16 million children live in families who would gain $630 or more, according to the center.

More than 1 in 3 of all Black and Latino children under 17 would benefit in the first year, as would 3 in 10 of all American Indian and Alaska Native children and 1 in 7 of all White and Asian children, according to the center.

The package would lift at least half a million children out of poverty and improve the financial situation of about 5 million more children who would remain below the poverty line, once the proposal is fully in effect in 2025, according to the center.

Families with moderate and higher incomes, as well as some with lower incomes, would benefit somewhat from the inflation adjustment provision. The maximum credit would rise to $2,100 per child in 2025, up from the current $2,000, according to the center’s projection.

The child tax credit and business tax changes would raise after-tax incomes for households by an average of $160 in 2023, with lower-income and high-income taxpayers receiving more noticeable tax cuts, according to the bipartisan Tax Policy Center.

Business tax relief and other provisions

What the main business provisions in the package would do:

Businesses could immediately deduct the cost of their US-based research and experimentation investments instead of over five years.

The deal would restore businesses’ ability to immediately deduct 100% of their investment in machinery and equipment.

It would relax the tightened limits on the deductibility of interest expenses, which mainly affects companies that have a lot of debt.

These tax breaks were originally part of the 2017 GOP Tax Cuts and Jobs Act but have recently ended or begun to phase out.

The three provisions run through 2025.

What the other provisions would do:

The package would remove the current double taxation for businesses and workers with operations in both the US and Taiwan.

It would increase the amount of investment a small business can immediately write off. The cap would then be indexed to inflation, starting after 2024. This provision would not expire.

The deal would provide relief for those affected by disasters, including recent hurricanes, flooding, wildfires and the Ohio train derailment in East Palestine last year.

It would enhance the Low-Income Housing Tax Credit in an effort to increase the supply of low-income housing. This would provide more than 200,000 new and preserved affordable rental homes, according to Novogradac.

It would accelerate the deadline for filing backdated claims for the Employee Retention Credit, a Covid 19-era program that has been subject to widespread fraud, to January 31, 2024, instead of April 15, 2025. That provision is estimated to save taxpayers more than $78 billion – offsetting most of the cost of the package, according to the Joint Committee on Taxation.

What else could hold up passage:

Some Republicans in blue states are pushing for the package to increase the temporary $10,000 cap on state and local tax deductions from federal income taxes that was imposed by the 2017 GOP Tax Cuts and Jobs Act. The cap is set to expire after 2025.

Raising the limit could be very costly. Once the cap expires, the federal government is projected to lose an additional $116 billion in tax revenue in 2026, according to the Joint Committee on Taxation.

The-CNN-Wire™ & © 2024 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.