Fact check: Cotham says NC budget includes 'largest' ever income tax cut

A North Carolina legislator who recently switched political parties is touting what she characterized as her new party’s efforts to deliver historic tax cuts.

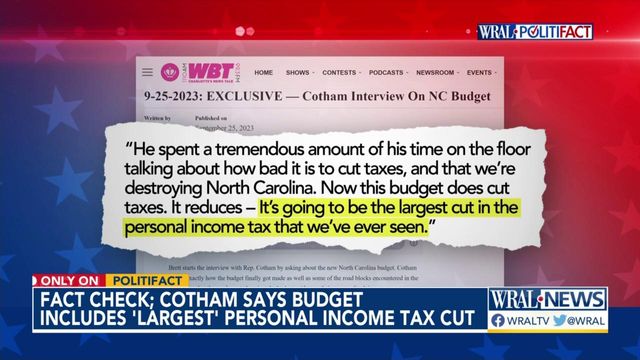

State Rep. Tricia Cotham of Mecklenburg County, a longtime Democrat when she was elected, joined the Republican Party in April. In a Sept. 25 interview with WBT-FM radio, Cotham slammed members of her former party for not supporting the GOP-authored state budget.

Most Democrats said they opposed the budget in part because they fear it won’t generate enough revenue to fund the needs of a growing state.

“Now this budget does cut taxes,” Cotham said. “It’s going to be the largest cut in our personal income tax that we’ve ever seen.”

Cotham didn’t clarify what time period she was talking about. But it’s clear she was referencing the budget that was enacted this week, which lays out a plan to incrementally lower the income tax rate over the next 10 years.

So, should North Carolinians expect an imminent record-setting cut? That wasn’t a claim we saw in press releases about the budget from Republican Senate leader Phil Berger or Republican House Speaker Tim Moore.

And there could be a reason for that: While legislative leaders continue to push the income tax rate to new modern-day lows, this budget’s cut of the income tax rate isn’t historically-large. The state’s current personal income tax is 4.75%. If the state meets certain revenue benchmarks, the rate would be as low as 2.49% in 2033 — a reduction of 2.26 percentage points.

Many North Carolinians saw bigger tax-rate cuts in the previous 10 years.

Rates through the years

Between 1989 and 2013, North Carolina’s personal income tax rate ranged from 6% to 8.25%. A person’s rate depended on how much taxable income they reported and how they chose to file: single, married filing jointly, married filing separately, etc.

About 52% of taxpayers qualified at 7% in 2013, but some paid a rate as high as 7.75%. That year, Republican legislators launched a plan to cut the personal income tax rate over time.

For people on the upper end of the range in 2013, the tax rate has been cut by 3 percentage points to today’s rate — far more than what is planned in the new budget.

Now let’s look at this on a year-over-year basis. In 2014, lawmakers enacted a flat personal income tax rate of 5.8% — a cut of 1.2 percentage points or more for those paying 7% and nearly 2 percentage points for those who paid a 7.75% rate in 2013.

That change stands as the largest year-over-year cut in recent history. Under the proposed budget, the biggest year-over-year cut would be half a percentage point. And that’s only if revenue goals are met.

For 2024, the state budget sets an income tax rate of 4.5%, a year-over-year cut of 0.25 percentage points. It then implements rates of 4.25% in 2025 and 3.99% in 2026.

Deeper cuts possible

The budget allows for deeper cuts to the income tax rate — but not until 2027 and only if the state hits revenue benchmarks set by the budget.

In the 2027 tax year, the personal income rate is scheduled to be 3.99%, but it can drop to 3.49% if the state generates $33.04 billion in revenue in fiscal year 2025-26. The rate can decrease another 0.5 of a percentage point each year thereafter, so long as the state hits those revenue targets.

North Carolina could lower its income tax rate to 2.49% by 2030 — potentially giving the state the nation’s lowest flat income tax.

PolitiFact NC reached out to Cotham for comment, but she didn’t respond. Responding on her behalf, Moore’s office referred to the 2030 goal and noted that the budget accelerates tax cuts in the coming years.

“The budget puts North Carolina on a statutory path for a 2.49% income tax rate, while increasing the speed of previously enacted income tax cuts that will benefit NC families for years to come,” Moore’s office said in an email statement. “Once fully implemented, this will be the most significant tax reduction in state budget history.”

Our ruling

Cotham said North Carolina’s state budget includes “the largest cut in our personal income tax that we’ve ever seen.”

If we look at year-over-year changes in the state’s personal income tax rate, the budget allows for, at most, a drop of half of a percentage point — and only if revenue goals are met. That falls short of the single-year change from 2013 to 2014, when most North Carolina taxpayers experienced a rate drop of more than 1 percentage point.

If we look at the budget’s plan for the next 10 years, the rate could drop 2.26 percentage points. That’s less than the 3-point drop some North Carolina taxpayers enjoyed between 2013 and 2023.

Although the budget may represent a cut, it doesn’t represent the largest, as Cotham claimed. We rate Cotham’s claim False.